Your dream RV might be turning into a financial nightmare, and you’re not alone. The recreational vehicle industry has experienced unprecedented changes since COVID-19, leaving countless RV owners struggling with loans that exceed their vehicle’s value. This phenomenon, known as being “underwater” on your loan, has become alarmingly common across America.

Recent market data shows that many RV owners need to put down an additional 20% just to break even on their loans when trying to sell. The combination of inflated COVID-era prices, increased supply from dealerships, and rapid depreciation has created a perfect storm for RV owners. Understanding these challenges is crucial whether you’re considering buying your first RV, already own one, or are exploring rental opportunities to offset your costs.

In this comprehensive guide, we’ll explore seven critical insights about RV loans and the emerging rental market that could help you navigate these turbulent waters and potentially turn your RV investment around.

Would you like to save this article?

1. The 20% Rule: Why Most RV Owners Are Trapped

The shocking reality is that most RV owners today need to come up with an additional 20% of their loan balance just to break even when selling their vehicle. This means if you owe $80,000 on your RV, you might need to bring $16,000 to the table just to get out of the loan.

This underwater situation stems from several factors:

- Inflated COVID-era pricing that drove RV values to unsustainable levels

- Mass dealership inventory flooding the used market

- Rapid depreciation especially on motorized RVs

The RV rental market has emerged as a potential solution, with platforms like Fireside RV Rental helping owners generate income to pay down their principal faster. However, this approach requires careful planning to avoid accelerating depreciation through excessive use.

Here’s the thing about being underwater on an RV loan – it’s like being stuck in quicksand. The more you struggle by trying to sell quickly, the deeper you sink into negative equity. Smart RV owners are now looking at rental income as their rope to climb out.

2. COVID’s Lasting Impact on RV Values

The pandemic created an artificial RV bubble that’s now bursting, leaving owners with vehicles worth far less than their purchase price. During 2020-2021, RV demand skyrocketed as people sought safe, isolated travel options, driving prices to historic highs.

Key statistics from the RV industry show:

- RV market size: Expected to reach $53.74 billion by 2030

- Economic impact: $140 billion annually on the US economy

- Post-COVID reality: Values now similar to or below late-2023 levels

The challenge for current owners is competing with dealerships who are aggressively pricing their inventory to clear lots. This creates downward pressure on private party sales, making it even harder for underwater owners to escape their loans.

It’s like buying a house at the peak of a housing bubble – except RVs depreciate much faster than real estate. The COVID bump was great for dealers, but terrible for anyone who bought at the peak.

3. The Mileage Trap: Why Unlimited Rentals Are Dangerous

Some RV rental platforms promote “unlimited mileage” to attract renters, but this can be devastating for RV owners. When you allow unlimited mileage, you’re essentially gambling with your vehicle’s value, as high-mileage RVs depreciate exponentially faster.

Consider this scenario: A renter takes your RV from Wisconsin to Florida for a weekend trip – that’s potentially 2,000 miles in four days. At typical depreciation rates, this could cost you thousands in lost value.

Smart rental management includes:

- Mileage fees that go directly to owners

- Daily generator usage limits

- Proper insurance coverage

- Regular maintenance schedules

Fireside RV Rental addresses this by implementing mileage fees that compensate owners for wear and tear, protecting their investment while still allowing profitable rentals.

Unlimited mileage on RV rentals is like giving someone a blank check to destroy your investment. It’s marketing genius for the platform, but financial suicide for the owner.

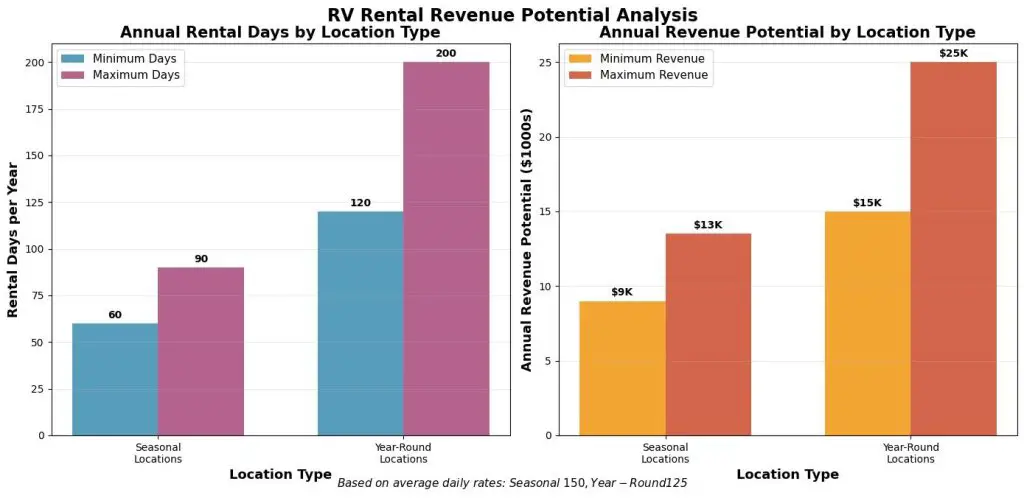

4. Location Determines Your Rental Success

Your geographic location dramatically impacts your RV rental potential, with some areas generating 3x more revenue than others. Understanding seasonal versus year-round markets is crucial for realistic income projections.

Seasonal Markets (Like Wisconsin)

- Rental frequency: 7-10 times per season

- Daily rates: Higher ($150+ average)

- Revenue potential: $9,000-$13,500 annually

- Best for: Towable RVs with lower depreciation

Year-Round Markets (Arizona, California, Florida)

- Rental frequency: 15-30 times per year

- Daily rates: Moderate ($125 average)

- Revenue potential: $15,000-$25,000 annually

- Best for: All RV types with proper exit strategies

The data shows that while year-round locations offer more rental opportunities, seasonal markets can be highly profitable due to premium pricing during peak demand periods.

Your ZIP code might be worth more than your RV model when it comes to rental income. A towable trailer in Scottsdale can out-earn a Class A motorhome in Milwaukee.

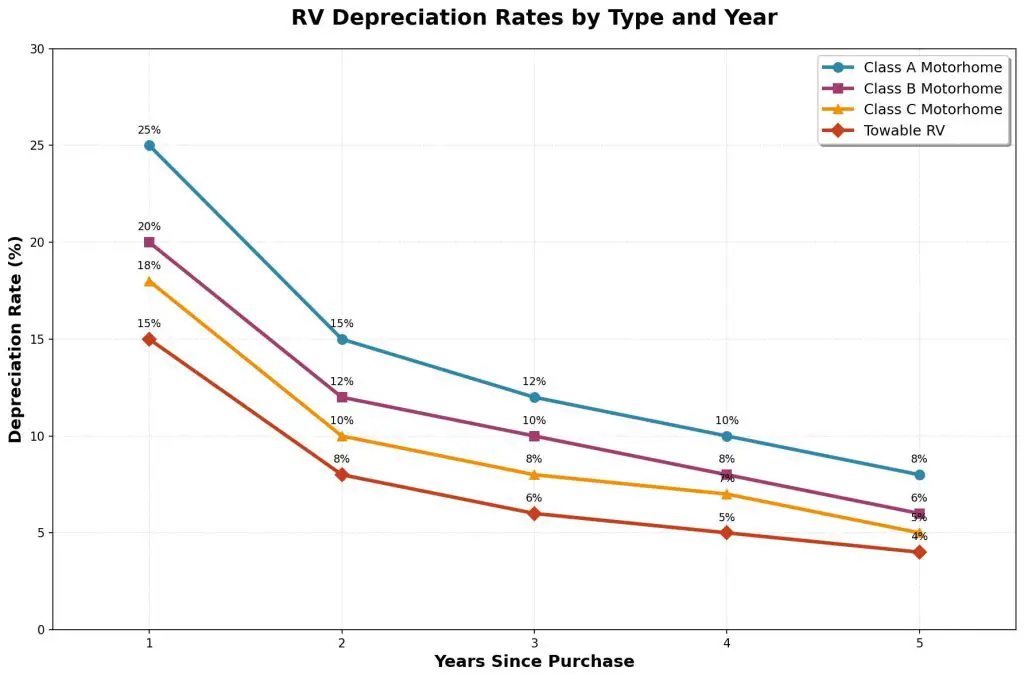

5. Towable vs. Motorhome: The Smart Money Choice

If you’re buying an RV specifically for rental income, towable RVs are the clear winner over motorhomes. The depreciation math is dramatically different between these two categories.

Why Towables Win for Rentals:

- Lower initial depreciation: 15% vs. 25% for Class A

- No mileage concerns: Renters can’t put miles on a trailer

- Longer rental lifespan: 5-6 years vs. 2-3 years for motorhomes

- Better exit strategy: Easier to sell when ready to exit

Motorhome Challenges:

- Mileage accumulation: Every rental adds wear and tear

- Higher maintenance costs: Engines, transmissions, and chassis

- Rapid depreciation: 25% first year for Class A units

- Complex exit planning: Requires established sales channels

The industry data is clear: unless you have a specific exit strategy (like Cruise America’s retail network), avoid buying motorhomes solely for rental purposes.

Thinking about buying a motorhome to rent out? You might as well buy a luxury car and hand the keys to teenagers. Stick with towables unless you enjoy watching money disappear.

6. The Insurance and Liability Reality

RV rental insurance is more complex than traditional auto insurance, and standard policies often don’t cover commercial use. Understanding your liability exposure is crucial before entering the rental market.

Key Insurance Considerations:

- Commercial vs. Personal Use: Most personal policies exclude rental activities

- Specialized RV Rental Insurance: Available through providers like National General and Progressive

- Liability Coverage: Protects against accidents and property damage

- Physical Damage: Covers repairs from renter negligence

Platform Partnerships:

Established rental platforms typically partner with insurance providers to offer:

- Driver verification and screening

- Security deposit collection

- Damage assessment procedures

- Claims processing assistance

Storage facility owners entering the RV rental business should consult with their existing commercial insurance providers to ensure proper coverage for this new revenue stream.

RV rental insurance is like wearing a helmet while riding a motorcycle – you hope you never need it, but you’ll be really glad you have it when someone decides to take your $100,000 motorhome off-roading.

7. The Franchise Model: Scaling Beyond Individual Ownership

The emerging RV rental franchise model offers opportunities for entrepreneurs and storage facility owners to scale beyond single-vehicle ownership. This represents a significant shift in how the industry operates.

Franchise Benefits:

- Revenue sharing: Typically 50% split with RV owners

- Professional management: Handles bookings, cleaning, and maintenance

- Insurance handling: Simplified coverage through platform partnerships

- Marketing support: Established brand recognition and advertising

Storage Facility Integration:

Storage facilities are uniquely positioned to capitalize on this trend because they:

- Already have RV owners as customers

- Possess suitable locations for rental operations

- Understand the local RV market

- Have existing commercial insurance and infrastructure

The franchise model allows for geographic expansion without the capital requirements of purchasing inventory, making it an attractive option for business-minded individuals.

The RV rental franchise model is like being a hotel manager without buying the building – you get all the profit potential without the massive upfront investment.

Revenue Potential Summary

| Location Type | Daily Rate | Annual Days | Revenue Range |

|---|---|---|---|

| Seasonal | $150 | 60-90 | $9,000-$13,500 |

| Year-Round | $125 | 120-200 | $15,000-$25,000 |

Conclusion

The RV industry is experiencing a major correction that’s left many owners underwater on their loans. However, the rental market offers a potential lifeline for those willing to approach it strategically. Success requires understanding depreciation rates, managing mileage carefully, choosing the right RV type, and having proper insurance coverage.

Whether you’re an underwater RV owner looking for relief or an entrepreneur considering the rental business, the key is education and realistic expectations. The industry is evolving rapidly, and those who adapt with smart strategies will survive and thrive.

SOURCES

- How to Survive an RV Loan (and Avoid Disaster) – YouTube

- Recreational Vehicle Market Size & Growth Trends – Global Growth Insights

- RV Industry Economic Impact Study – RVIA

- RV Depreciation Rates and Market Analysis – Kirkland RV Sales

- RV Rental Market Analysis 2024 – Verified Market Research

- Rising Underwater Loans Analysis – ClearCar